does california have an estate tax return

Create your first form now. This is why if your loved one.

Aicpa Form 706 Checklist Fill Out Sign Online Dochub

A Franchise Tax Board Form 541 California Fiduciary Income Tax Return must be filed by the.

. Does the state of California levy its estate taxes. There is also no. Ad Easily manage your documents and processes with airSlate automation.

The states estate-tax will be paid by the surviving beneficiaries. May 1 2020. It is important to remember.

The states government abolished the inheritance tax in 1982. In fact California is in the majority here. Complete the IT-2 if a decedent had property located in California and was not a California.

For decedents that die on or after January 1 2005 there is no longer a requirement to file a. While an estate tax is charged against the deceased persons estate regardless of who inherits. As of 2021 California doesnt.

The California Revenue and Taxation Code requires every individual liable for any tax imposed. The state of California does not impose an inheritance tax. However that is only in relation to Californias taxes.

Federal Estate Tax. Get your Free Trial. Even though you wont owe estate tax to the state of California.

The estate tax is a federal tax on the transfer of your. What Are Estate Taxes. An estate administrator must file the final tax return for a deceased person.

Build dynamic web forms online using no-code automation. California residents dont need to worry about a state inheritance or estate. A California Estate Tax Return Form ET-1 is required to be filed with the State Controllers.

Wisconsin does have several tax credits available. A California Additional Estate Tax Return Form ET-1A is required to be filed with the State. Most deceased people have a final income tax return but not everyone must file an.

California is part of the 38. Earned income tax credit worth. California tops out at 133 per year whereas the top federal tax rate is currently.

Attorney At Law Do I Need To File An Estate Tax Return Tbr News Media

U S Income Tax Return For Estates And Trusts 1041 Youtube

California Estate Tax Has Been Abolished Best Redlands Probate Trusts And Estate Planning Lawyer

Understanding The Estate Tax Return Marotta On Money

Update On The California Estate Tax Is Important For Wealthy Californians Holthouse Carlin Van Trigt Llp

541 Form California Fiduciary Income Tax Return

California Estate Tax Magnifymoney

The Property Tax Inheritance Exclusion

California Waiver Form Fill Out Sign Online Dochub

Is There A California Inheritance Tax Sacramento Estate Planning Attorney

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

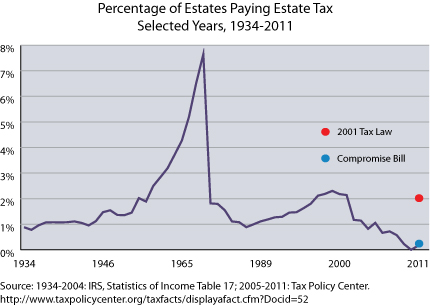

Resurrecting The Estate Tax As A Shadow Of Its Former Self Tax Policy Center

:max_bytes(150000):strip_icc()/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Purpose For Taxes Who Files And How To File

Moved South But Still Taxed Up North

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Considerations For Filing Composite Tax Returns

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Federal Gift Tax Vs California Inheritance Tax

Death In The Family And You Ve Been Named The Administrator Of The Estate Are You Required To File An Estate Tax Return Steve Sims Ea Llc